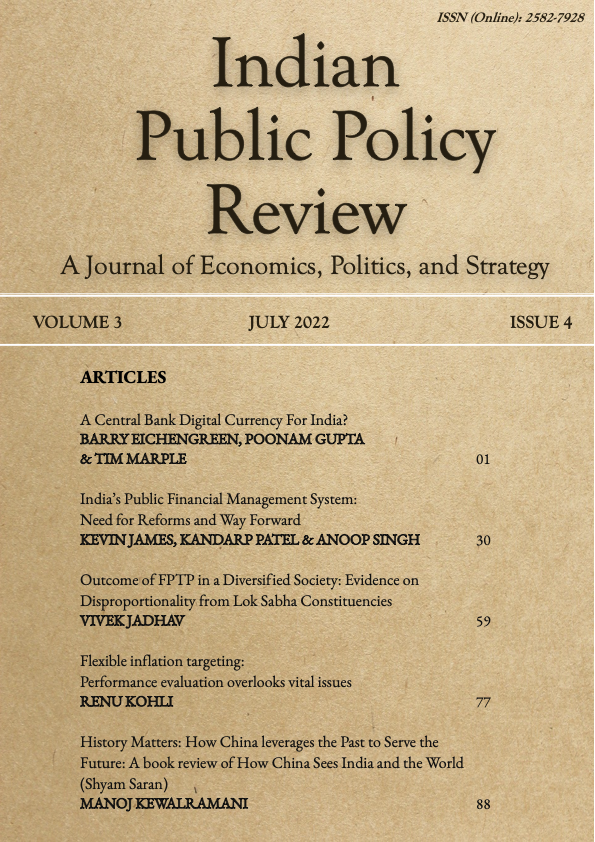

Vol. 3 No. 4 (Jul-Sep) (2022): Indian Public Policy Review

In the July issue of 2022, Barry Eichengreen, Poonam Gupta and Tim Marple review the arguments for the issuance of a Central Bank Digital Currency for India and review India's progress with other countries. Kevin James, Kandarp Patel and Anoop Singh's paper examines the key areas in which India needs Public Financial Management reforms and charts a comprehensive way forward for achieving it. Using constituency-level information, the paper by Vivek Jadhav examines how social diversity, religious diversity, and fractionalization affect the electoral outcomes in a First-past-the-post system. In her paper, Renu Kohli analyses some vital aspects of India’s flexible inflation targeting (FIT) regime and recommends further testing over different economic cycles before claiming success of the regime. Manoj Kewalramani reviews "How China Sees India and the World", the latest book by Shyam Saran.