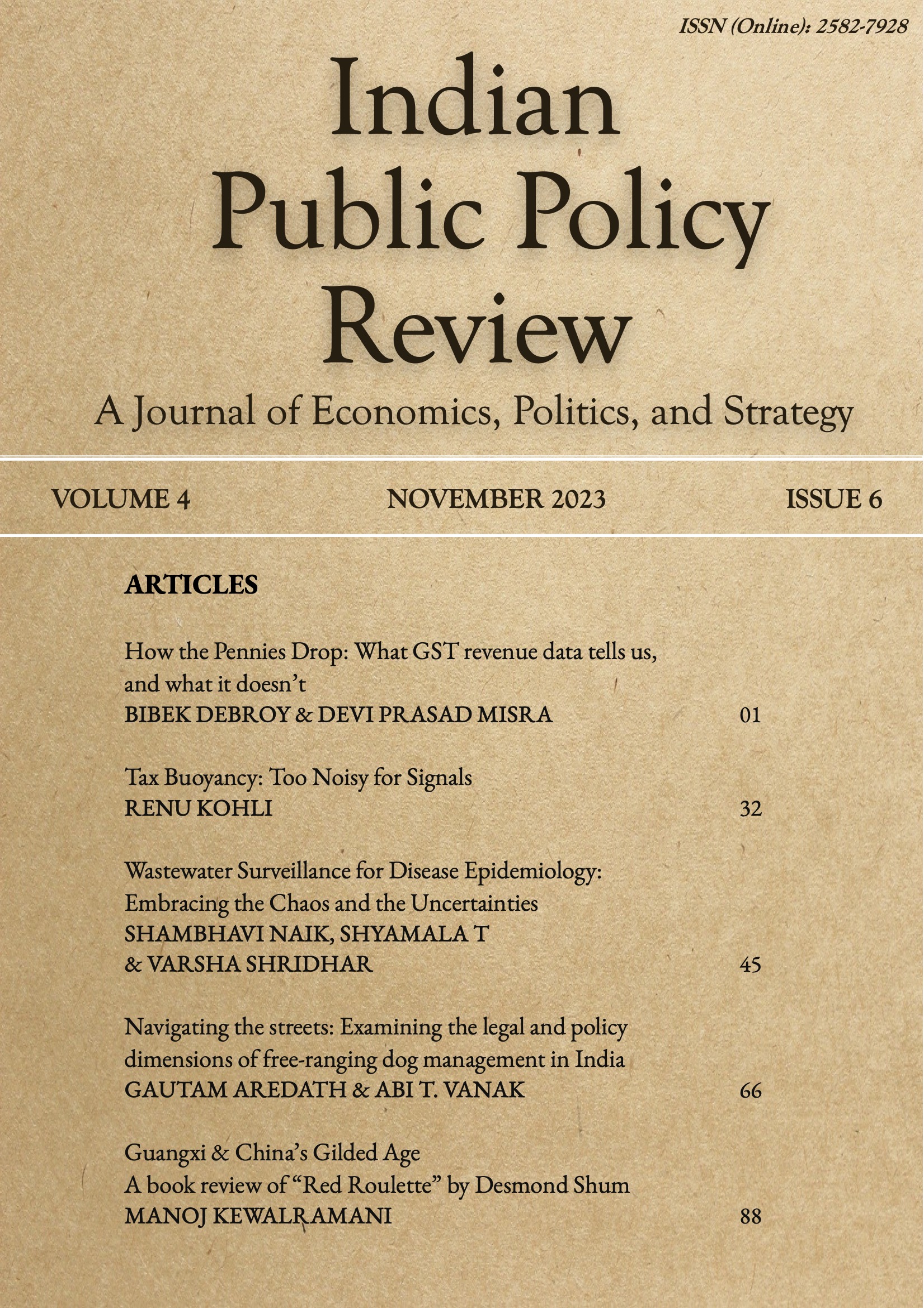

Vol. 4 No. 6 (Nov-Dec) (2023): Indian Public Policy Review

In the final issue of 2023, Bibek Debroy and Devi Prasad Misra's paper demonstrates that the Goods and Services Tax (GST) has delivered on revenue growth, formalization of the economy, reduced rates of taxation, and the creation of a more unified market. The paper by Renu Kohli focuses upon tax buoyancy, which includes discretionary policy changes, to examine how the historical relationship of tax revenues with income may have been disturbed by exceptional shocks. In their paper, Shambhavi Naik, Shyamala and Varsha Shridhar outline wastewater-based epidemiological surveillance efforts around the world, highlights its advantages as a cost-effective tool to supplement existing frameworks, and makes a case for its implementation in India, along with recommendations for next steps towards such implementation. Gautam Aredath and Abi T. Vanak's paper presents a critical discussion of the legal and policy position of dog population management in India and suggests integrated and contextual approaches for its viable management. Finally, Manoj Kewalramani reviews Desmond Shum's book "Red Roulette" and calls it "an important book to understand the political imperatives that have shaped China’s return to ideology under Xi Jinping"