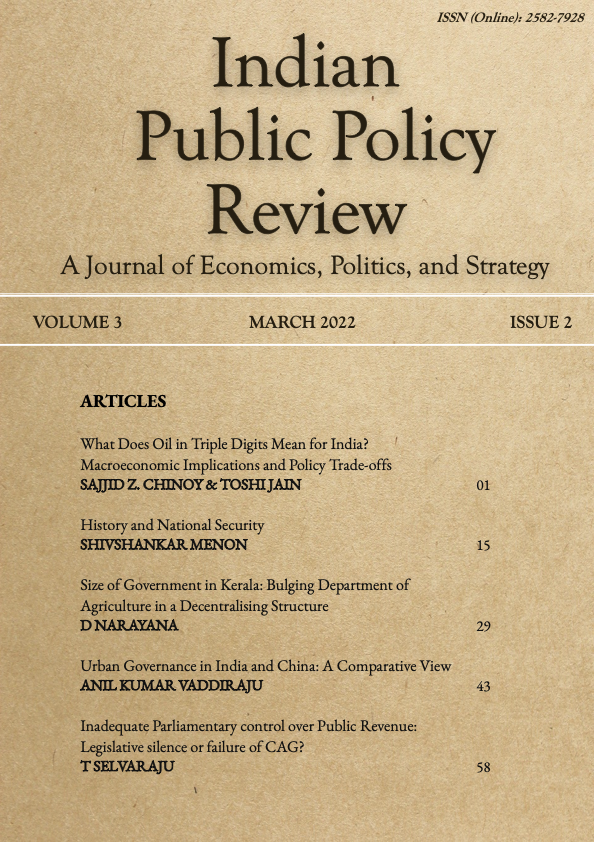

Vol. 3 No. 2 (Mar-Apr) (2022): Indian Public Policy Review

In the March issue, Sajjid Chinoy and Toshi Jain look at the macroeconomic impact of increased global oil prices and offer mitigating policy recommendations. The paper by Shivshankar Menon examines the links between the history we choose to tell ourselves and its implications for national security in India. D Narayana analyses the size of the state governments and efficiency of the Agriculture Department by comparing the number of employees per unit area under cultivation in Kerala with that in Karnataka and Telangana. Anil Kumar Vaddiraju's paper looks at the extent to which urban governments in India and China have moved from traditional government to network governance. T Selvaraju studies the level of parliamentary control over public finance in India and concludes that there is disproportionately lesser parliamentary oversight over public revenue compared to public spending.