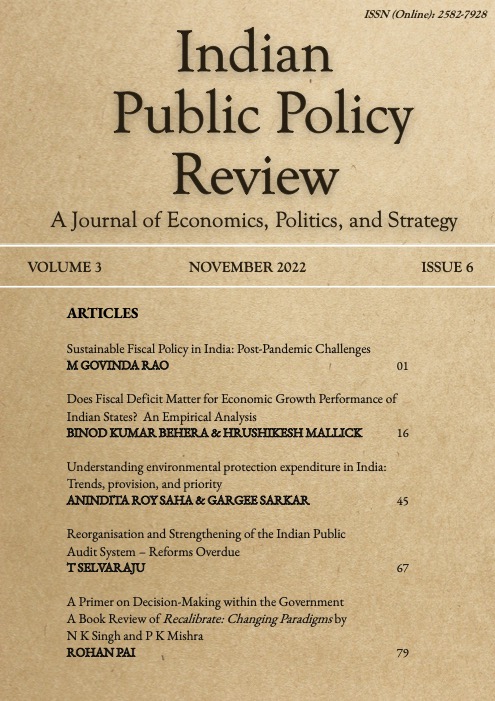

Vol. 3 No. 6 (Nov-Dec) (2022): Indian Public Policy Review

In the final issue of 2022, M Govinda Rao's paper argues for reforms in budget management and the creation of an independent fiscal council to monitor the implementation of rule-based fiscal policy to impart effectiveness to fiscal management. Binod Kumar Behera and Hrushikesh Mallick's study tries to empirically evaluate the effects of fiscal deficits on the economic growth of 14 major Indian states from 1980-81 to 2019-20. The paper by Anindita Roy Saha and Gargee Sarkar examines the recent trends of environmental protection expenditure in India and finds a visibly lower share of EPE in total expenditure and lower rate of growth in comparison to other expenditure items of the government. The article by T Selvaraju aims to ascertain whether the Comptroller and Auditor General of India (CAG) functions as per its given mandate and makes recommendations to reorganise and strengthen the institution to better serve its purpose. Finally, Rohan Pai reviews Recaliberate: Changing Paradigms, a book by NK Singh and PK Mishra.